What is Environmental, Social, and Governance (ESG)? A Guide for Businesses

In today’s business world, companies face growing pressure to demonstrate their commitment to environmental protection, social responsibility, and ethical governance. ESG (Environmental, Social, and Governance) provides a framework for meeting these expectations. Understanding what ESG means and why it matters has become essential for businesses of all sizes looking to thrive in an increasingly conscious marketplace.

ESG represents a framework that helps organisations measure and improve their impact on the planet, people, and communities whilst maintaining transparent and accountable leadership. For businesses, embracing ESG principles is no longer optional; it’s a strategic necessity that opens doors to investment, strengthens brand reputation, and builds long-term resilience.

What is ESG?

ESG stands for Environmental, Social, and Governance, three key pillars that form a comprehensive framework for evaluating how a company operates beyond traditional financial metrics. This ESG meaning encompasses a business’s entire non-financial performance, providing stakeholders with crucial insights into corporate responsibility and sustainability practices.

The ESG framework measures how businesses integrate responsible practices into their operations, assess their impact on society and the environment, and demonstrate accountability to shareholders and stakeholders alike. Rather than focusing solely on profit margins, ESG evaluates whether companies are building sustainable business models that create value for all stakeholders whilst minimising negative impacts.

What Does ESG Stand For?

Understanding what ESG stands for requires examining each pillar individually:

- Environmental factors assess how a company interacts with the natural world. These factors include carbon emissions, energy consumption, waste management, water usage, pollution control, and biodiversity impacts. Companies demonstrating strong environmental performance typically implement renewable energy sources, reduce their carbon footprint, adopt circular economy principles, and develop greener products and services. Environmental considerations also encompass how businesses prepare for and respond to climate-related risks, such as extreme weather events or regulatory changes aimed at limiting global warming.

- Social criteria examine how businesses manage relationships with employees, suppliers, customers, and communities. This pillar covers labour practices, workplace health and safety, diversity and inclusion initiatives, human rights protections, fair wages, employee wellbeing programmes, and community engagement. Social responsibility also extends throughout the supply chain, ensuring suppliers uphold ethical standards such as preventing modern slavery and respecting freedom of association. Companies with strong social sustainability practices tend to attract and retain top talent while building stronger customer loyalty.

- Governance refers to the systems, processes, and structures that guide corporate decision-making, reporting, and accountability. Governance activities include board composition and diversity, executive compensation policies, shareholder rights, audit processes, internal controls, ethical business conduct, anti-corruption measures, and transparency in financial reporting. Strong governance practices ensure that companies operate with integrity, make decisions transparently, and maintain checks and balances that prevent conflicts of interest or unethical behaviour.

These three pillars work together to provide a comprehensive view of a company’s sustainability performance. Organisations that excel across all three dimensions demonstrate their commitment to creating long-term value whilst managing risks and maintaining ethical standards.

Why Is ESG Important?

The importance of ESG has grown dramatically as stakeholders increasingly recognise that companies with strong ESG practices are better positioned for long-term success. According to research, approximately two-thirds of investors now consider ESG factors when making investment decisions, signalling a fundamental shift in how businesses are evaluated.

Why ESG is vital for business becomes clear when examining the multiple benefits it delivers. ESG helps companies identify and mitigate risks, including environmental disasters, supply chain disruptions, reputational damage, and regulatory penalties. By proactively addressing ESG issues, businesses can avoid costly crises, protect their bottom line, and build resilience against future challenges.

Moreover, ESG performance directly influences a company’s ability to attract capital. A 2024 Morgan Stanley survey found that 77% of global investors are interested in sustainable investing, whilst ESG-oriented investments have grown to over $30 trillion globally, a tenfold increase since 2004. This surge demonstrates that ESG investing is far more than a passing trend; it represents a fundamental transformation in how capital markets operate.

Regulatory pressures also make ESG essential. Governments worldwide are implementing stricter disclosure requirements and sustainability standards. Companies that embrace ESG proactively position themselves ahead of mandatory regulations, avoiding rushed compliance efforts and potential penalties. In regions like Singapore and Malaysia, ESG reporting frameworks are becoming increasingly sophisticated, with listed companies facing mandatory sustainability reporting requirements.

Beyond compliance and capital access, ESG matters because it aligns business operations with evolving consumer values. Research shows that over 70% of consumers are willing to pay an additional 5% for products from companies with strong environmental credentials. This consumer preference creates competitive advantages for businesses that authentically demonstrate their commitment to sustainability and social responsibility.

Finally, ESG is essential because it drives innovation and operational excellence. Companies focused on environmental sustainability often discover cost-saving opportunities through energy efficiency, waste reduction, and resource optimisation. Social initiatives improve employee engagement and retention, whilst strong governance structures enhance decision-making quality and stakeholder trust.

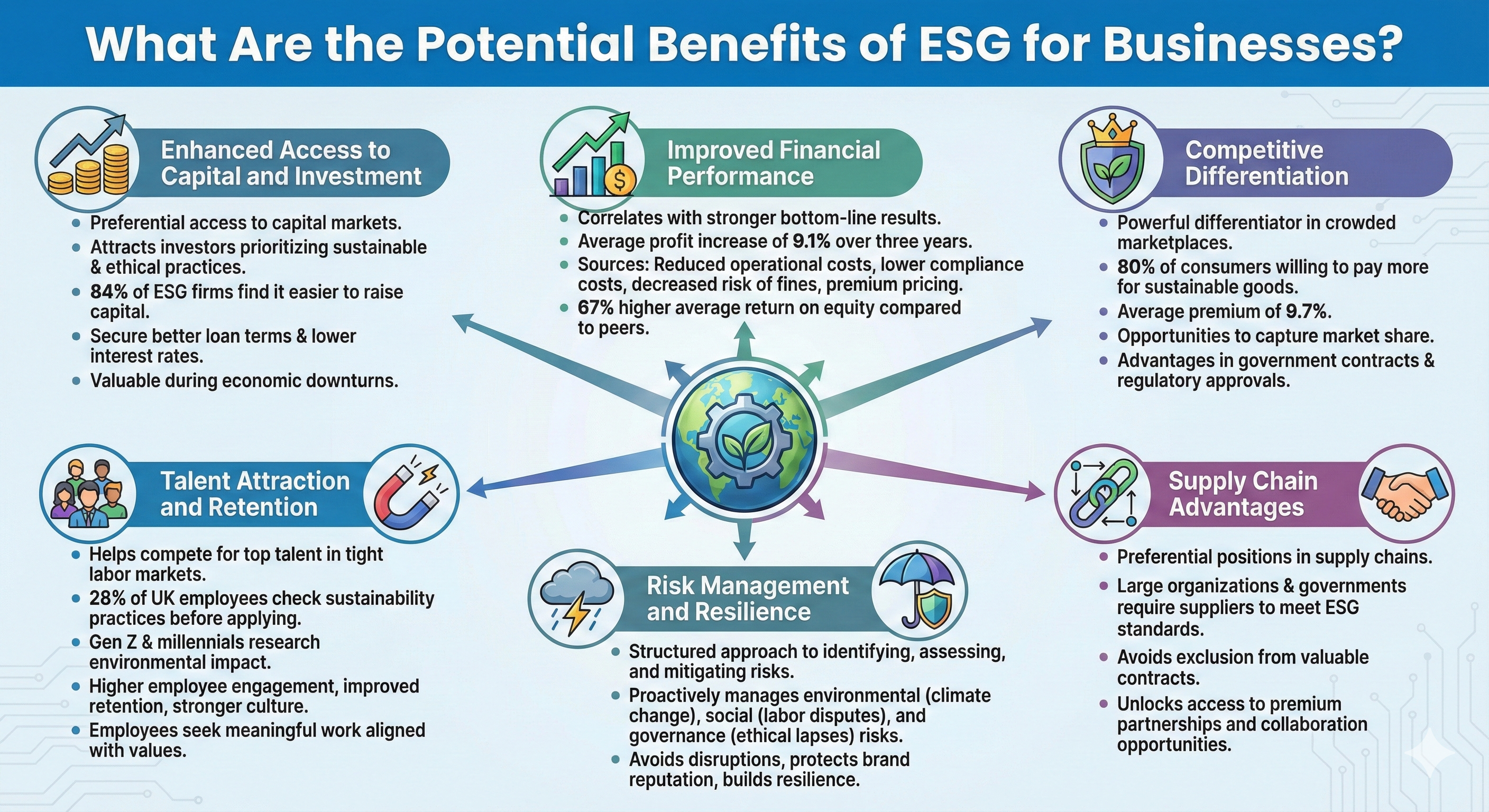

What Are the Potential Benefits of ESG for Businesses?

Implementing ESG principles delivers tangible advantages that strengthen both financial performance and competitive positioning. These benefits extend across multiple dimensions of business operations.

- Enhanced Access to Capital and Investment: Companies with robust ESG performance enjoy preferential access to capital markets. The inclusion of ESG reporting in earnings statements attracts investors who prioritise sustainable and ethical business practices. Research indicates that 84% of companies following ESG principles find it easier to raise capital, whilst firms with strong ESG credentials often secure better loan terms and lower interest rates from financial institutions. This access to capital becomes particularly valuable during economic downturns when investors favour companies with proven risk management capabilities.

- Improved Financial Performance: ESG adoption correlates with stronger bottom-line results. Studies show that companies that publicly emphasise ESG experience an average profit increase of 9.1% over three years, with some markets showing even higher gains. This financial outperformance stems from multiple sources, including reduced operational costs through efficiency improvements, lower regulatory compliance costs, decreased risk of fines and penalties, and premium pricing power with conscious consumers. Companies with strong ESG propositions achieve a 67% higher average return on equity compared to peers.

- Competitive Differentiation: In crowded marketplaces, ESG provides a powerful differentiator. PwC’s global research showing that around 80% of consumers are willing to pay more for sustainably produced or sourced goods, with an average premium of 9.7%. This preference creates opportunities for businesses to capture market share by demonstrating an authentic commitment to sustainable practices. Companies that lead on ESG issues also gain advantages in securing government contracts, regulatory approvals, and partnership opportunities with other sustainability-focused organisations.

- Talent Attraction and Retention: Strong ESG performance helps businesses compete for top talent in tight labour markets. In one UK survey, 28% of employees said they check a company’s sustainability practices before applying for a job. Separate global research also shows that a growing share of Gen Z and millennial workers actively research employers’ environmental impact and policies before accepting roles. Companies known for ESG leadership report higher employee engagement, improved retention rates, and stronger workplace culture. Employees increasingly seek meaningful work with organisations that share their values, making ESG commitment a critical factor in employer brand strength.

- Risk Management and Resilience: ESG frameworks provide structured approaches to identifying, assessing, and mitigating risks across operations. Environmental risks such as climate change impacts, social risks including labour disputes, and governance risks like ethical lapses can all be proactively managed through ESG practices. Companies that address these risks early avoid disruptions, protect brand reputation, and build resilience against future challenges. This risk mitigation capability becomes increasingly valuable as stakeholders demand greater transparency and accountability.

- Supply Chain Advantages: Businesses with strong ESG performance gain preferential positions in supply chains. Large organisations and government entities increasingly require suppliers to meet ESG standards, meaning companies without robust ESG practices risk exclusion from valuable contracts. Conversely, those demonstrating ESG excellence unlock access to premium supply chain partnerships and collaboration opportunities.

How Does ESG Differ from Sustainability?

Although frequently used interchangeably, ESG and sustainability represent distinct concepts with different purposes and applications. Understanding the difference helps businesses develop more effective strategies.

- Sustainability represents a holistic, long-term vision encompassing environmental stewardship, social equity, and economic viability. It focuses on meeting present needs without compromising future generations’ ability to meet their own needs. Sustainability takes a broader perspective that considers the interconnections between environmental health, social wellbeing, and economic prosperity. Companies pursuing sustainability aim to operate in ways that positively contribute to, or at a minimum, do not harm, the environment, society, and economy.

- ESG, conversely, provides a specific framework and set of criteria for evaluating corporate performance across environmental, social, and governance dimensions. ESG offers measurable standards that allow investors, stakeholders, and regulators to assess how well companies manage sustainability-related risks and opportunities. The ESG meaning in business centres on providing quantifiable data points that support decision-making, particularly around investment and risk assessment.

The key differences become clearer when examining their practical applications:

- Scope and Focus: Sustainability represents the destination, the end goal of achieving long-term balance across environmental, social, and economic systems. ESG provides the roadmap, a structured framework that helps organisations move towards sustainability through specific, measurable actions. Think of sustainability as the “why” and ESG as the “how” of responsible business.

- Measurement and Reporting: Sustainability encompasses both qualitative aspirations and quantitative measures, often communicated through broad commitments and narrative descriptions. ESG emphasises quantitative, standardised metrics that enable comparison and benchmarking across companies and industries. ESG metrics must be measurable, verifiable, and reported consistently, allowing stakeholders to track progress over time and compare performance across organisations.

- Stakeholder Perspective: Sustainability typically reflects an organisation’s internal values and commitment to operating responsibly. ESG, however, primarily serves external stakeholders, particularly investors, who need standardised information to evaluate financial materiality and risk exposure. This investor focus explains why ESG has become central to capital allocation decisions and why ESG reporting standards emphasise financially material topics.

- Strategic Integration: In practice, organisations should view sustainability as their overarching philosophy and ESG as the operational framework for implementing that philosophy. Companies committed to sustainability use ESG criteria to guide practices, measure progress, and communicate achievements to stakeholders. The most successful organisations integrate both concepts, ensuring their sustainability vision is supported by rigorous ESG management and transparent reporting.

Understanding this distinction helps businesses avoid common pitfalls. Some organisations pursue ESG primarily for compliance or investor relations without embedding genuine sustainability into their culture and operations, an approach that risks appearing superficial or even contributing to greenwashing accusations. The most effective strategy combines authentic sustainability commitment with robust ESG frameworks that deliver measurable results and credible reporting.

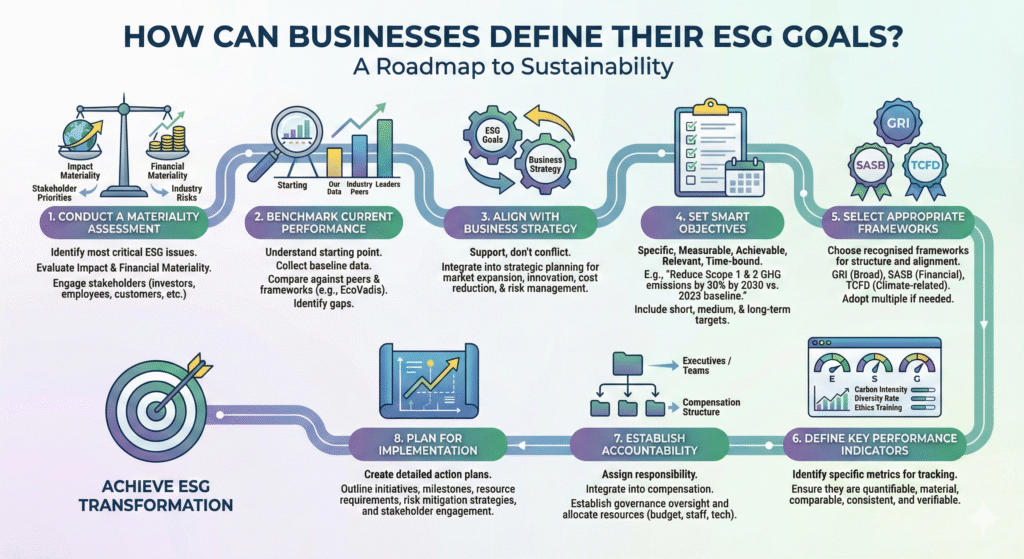

How Can Businesses Define Their ESG Goals?

Setting clear, actionable ESG goals forms the foundation of an effective sustainability strategy. Businesses should approach goal-setting systematically to ensure objectives align with both stakeholder expectations and operational realities.

- Conduct a Materiality Assessment: The first step is to identify which ESG issues matter most to the business and its stakeholders. A materiality assessment evaluates both impact materiality (how the organisation affects society and environment) and financial materiality (how ESG factors affect business value). This process requires engaging internal and external stakeholders, including investors, employees, customers, suppliers, regulators, and communities, to understand their priorities and concerns. The assessment should consider industry-specific risks and opportunities, competitive positioning, and geographic factors that influence ESG relevance.

- Benchmark Current Performance: Before setting targets, businesses must understand their starting point. Understanding this starting point involves collecting baseline data across relevant ESG metrics, comparing performance against industry peers and leaders, identifying gaps between the current state and best practices, and reviewing existing policies, processes, and initiatives. Companies can use frameworks like EcoVadis assessments or industry benchmarks to evaluate where they stand relative to expectations.

- Align with Business Strategy: ESG goals should support, rather than conflict with, the overall business objectives. The most successful companies integrate ESG considerations into strategic planning, ensuring sustainability objectives reinforce commercial aims such as market expansion, innovation, cost reduction, and risk management. This alignment helps secure executive buy-in and resource allocation whilst ensuring ESG initiatives deliver business value alongside societal benefits.

- Set SMART Objectives: Effective ESG goals follow the SMART framework, Specific, Measurable, Achievable, Relevant, and Time-bound. For example, rather than vaguely committing to “reduce emissions,” a SMART goal would state “reduce Scope 1 and 2 greenhouse gas emissions by 30% by 2030 compared to the 2023 baseline.” Goals should span different time horizons, including quick wins that build momentum (1-2 years), medium-term objectives that require systematic change (3-5 years), and ambitious long-term targets that drive transformation (10+ years).

- Select Appropriate Frameworks: Choosing recognised ESG frameworks helps structure goal-setting and ensures alignment with stakeholder expectations. The Global Reporting Initiative (GRI) provides comprehensive guidance covering broad sustainability topics. The Sustainability Accounting Standards Board (SASB) offers industry-specific standards focused on financially material issues. The Task Force on Climate-related Financial Disclosures (TCFD) provides guidance on climate-related goal-setting. Companies may adopt multiple frameworks depending on their reporting needs and stakeholder requirements.

- Define Key Performance Indicators: Once goals are established, businesses must identify specific metrics for tracking progress. Effective KPIs should be quantifiable, with precise units of measurement; material to the organisation’s impacts and value creation; comparable to industry benchmarks; consistently measured using the same methodologies; and verifiable through credible data sources. For environmental goals, this might include carbon emissions intensity, renewable energy percentage, or waste diversion rates. Social KPIs could track employee diversity, safety incident rates, or community investment. Governance metrics might measure board diversity, completion of ethics training, or whistleblower reports.

- Establish Accountability: Clear ownership drives results. Businesses should assign responsibility for ESG goals to specific executives or teams, integrate ESG performance into compensation structures, establish governance mechanisms for oversight and review, and allocate sufficient resources, including budget, staff, and technology. Many organisations create dedicated sustainability roles or committees whilst ensuring ESG accountability extends across all business functions.

- Plan for Implementation: Goals without roadmaps rarely succeed. Companies need detailed action plans outlining the initiatives required to achieve each objective, milestones marking progress along the way, resource requirements, including capital investment and operational changes, risk mitigation strategies to address potential obstacles, and stakeholder engagement plans to maintain support. This planning process should acknowledge that ESG transformation takes time and requires persistent effort across the organisation.

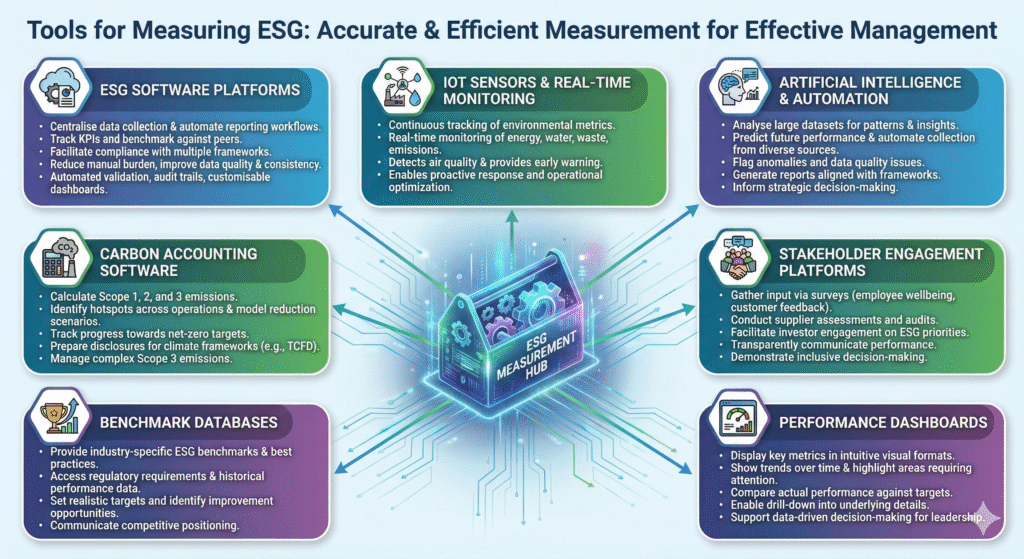

Tools for Measuring ESG

Accurate measurement forms the backbone of effective ESG management. Businesses today can leverage tools and technologies to streamline data collection, analysis, and reporting, improving accuracy and efficiency.

- ESG Software Platforms: Specialised ESG management platforms centralise data collection, automate reporting workflows, track key performance indicators, enable benchmarking against peers, and facilitate compliance with multiple frameworks. These platforms reduce the manual burden traditionally associated with ESG reporting whilst improving data quality and consistency. Leading solutions offer features such as automated data validation, audit trails for verification, customisable dashboards for different stakeholders, and integration with existing enterprise systems.

- IoT Sensors and Real-Time Monitoring: Internet of Things devices enable continuous tracking of environmental metrics. Sensors monitor energy consumption in real time, measure water use and efficiency, track waste generation and recycling rates, detect air quality and emissions levels, and provide early warning of environmental incidents. This real-time data enables businesses to identify issues quickly, respond proactively, and optimise operations to improve ESG performance.

- Artificial Intelligence and Automation: AI-powered tools transform ESG measurement by analysing large datasets to identify patterns and insights, predicting future performance based on historical trends, automating data collection from diverse sources, flagging anomalies or data quality issues, and generating reports aligned with various frameworks. Machine learning algorithms can also help companies understand relationships between different ESG factors and business outcomes, informing more strategic decision-making.

- Carbon Accounting Software: Given the centrality of climate action to ESG, specialised carbon accounting tools help businesses calculate Scope 1, 2, and 3 emissions, identify emission hotspots across operations, model scenarios for emission reduction, track progress towards net-zero targets, and prepare disclosures for climate frameworks like TCFD. These tools prove especially valuable for managing complex Scope 3 emissions spanning supply chains and product lifecycles.

- Stakeholder Engagement Platforms: Measuring social performance requires gathering input from various stakeholders. Digital platforms facilitate surveys to assess employee satisfaction and wellbeing, feedback mechanisms for customers and communities, supplier assessments and audits, investor engagement on ESG priorities, and transparent communication of ESG performance. These tools help businesses understand stakeholder perspectives whilst demonstrating commitment to inclusive decision-making.

- Benchmark Databases: Understanding relative performance requires comparison against peers. Various organisations maintain databases that provide industry-specific ESG benchmarks, best practice examples, regulatory requirements across jurisdictions, and historical performance data. Companies can use these resources to set realistic targets, identify opportunities for improvement, and communicate their competitive positioning.

- Performance Dashboards: Visual dashboards make ESG data accessible to decision-makers by displaying key metrics in intuitive formats, showing trends over time, highlighting areas requiring attention, comparing actual performance against targets, and enabling drill-down into underlying details. Well-designed dashboards help leadership teams understand ESG performance at a glance whilst supporting data-driven decision-making.

Selecting the correct measurement tools depends on company size, industry, ESG maturity, reporting requirements, and available resources. Many organisations start with basic tools and gradually adopt more sophisticated solutions as their ESG programmes mature. Working with ESG consultants can help businesses identify the most appropriate measurement tools for their specific needs.

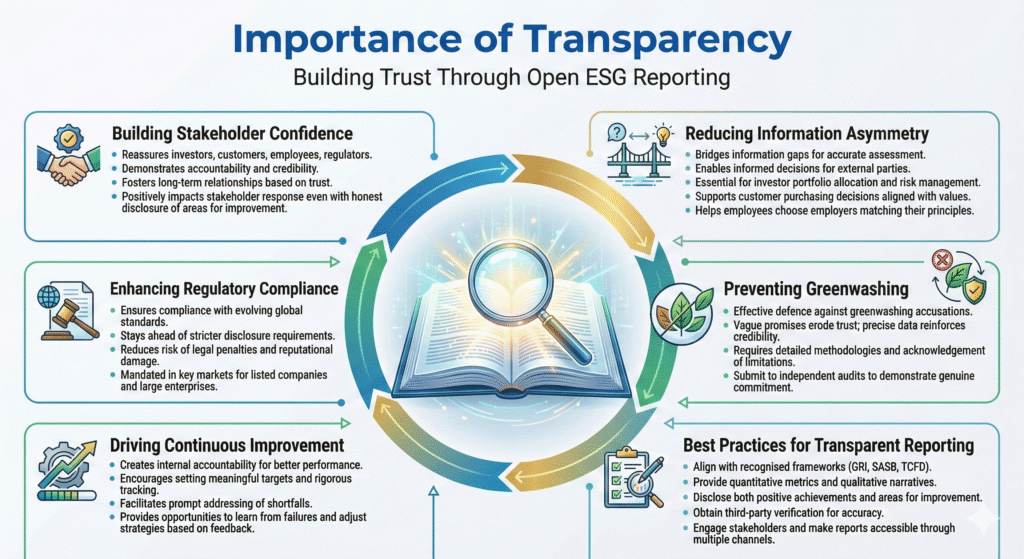

Importance of Transparency

Transparency sits at the heart of credible ESG performance, serving as the bridge between corporate action and stakeholder trust. Without transparent disclosure, even genuine sustainability efforts may be questioned or dismissed.

- Building Stakeholder Confidence: Transparent ESG reporting reassures investors, customers, employees, and regulators that a company is committed to responsible practices. When organisations openly share goals, achievements, and challenges, they demonstrate accountability and build credibility. Research shows that stakeholders respond positively to honest disclosure, even when companies acknowledge areas needing improvement. This transparency fosters long-term relationships based on trust rather than scepticism.

- Reducing Information Asymmetry: Without ESG disclosure, stakeholders struggle to accurately assess a company’s sustainability initiatives and governance structures. Transparent reporting bridges this information gap, enabling external parties to evaluate corporate performance and make informed decisions. For investors, this information proves essential for portfolio allocation and risk management. For customers, it supports purchasing decisions aligned with personal values. For employees, it helps them choose employers whose principles match their own.

- Enhancing Regulatory Compliance: Governments worldwide are implementing stricter ESG disclosure requirements. Companies that proactively embrace transparent reporting stay ahead of regulatory developments, ensuring compliance with evolving standards and reducing the risk of legal penalties and reputational damage. In markets like Singapore and Malaysia, sustainability reporting frameworks already mandate specific disclosures for listed companies and larger enterprises.

- Preventing Greenwashing: Transparency serves as the most effective defence against greenwashing accusations. Vague promises without supporting evidence quickly erode trust and invite scrutiny from regulators, media, and advocacy groups. Precise, consistent data backed by third-party verification demonstrates genuine commitment rather than empty marketing rhetoric. Companies should provide detailed methodologies, acknowledge limitations, and submit to independent audits to reinforce credibility.

- Driving Continuous Improvement: The discipline of transparent reporting creates internal accountability, driving better performance. When companies commit to public disclosure, they create pressure to deliver results and maintain progress over time. This transparency encourages organisations to set meaningful targets, track performance rigorously, and address shortfalls promptly. Regular reporting also provides opportunities to celebrate successes, learn from failures, and adjust strategies based on stakeholder feedback.

- Best Practices for Transparent Reporting: Effective transparency requires more than simply publishing data. Leading companies align with recognised frameworks like GRI, SASB, or TCFD to ensure consistency and comparability. They provide both quantitative metrics and qualitative narratives that explain context and strategy. They disclose both positive achievements and areas needing improvement, avoiding selective reporting that emphasises only favourable results. They submit reports to third-party verification or assurance to validate accuracy. They engage stakeholders in the reporting process, seeking input and addressing concerns raised. They make reports easily accessible through company websites and communicate findings through multiple channels.

Organisations looking to strengthen transparency should review their current disclosure practices, identify gaps relative to stakeholder expectations and regulatory requirements, and develop plans to enhance reporting quality and comprehensiveness. Elite Asia’s ESG services can guide companies through this process, ensuring disclosures meet international standards whilst effectively communicating sustainability performance.

Benefits of Tracking Progress

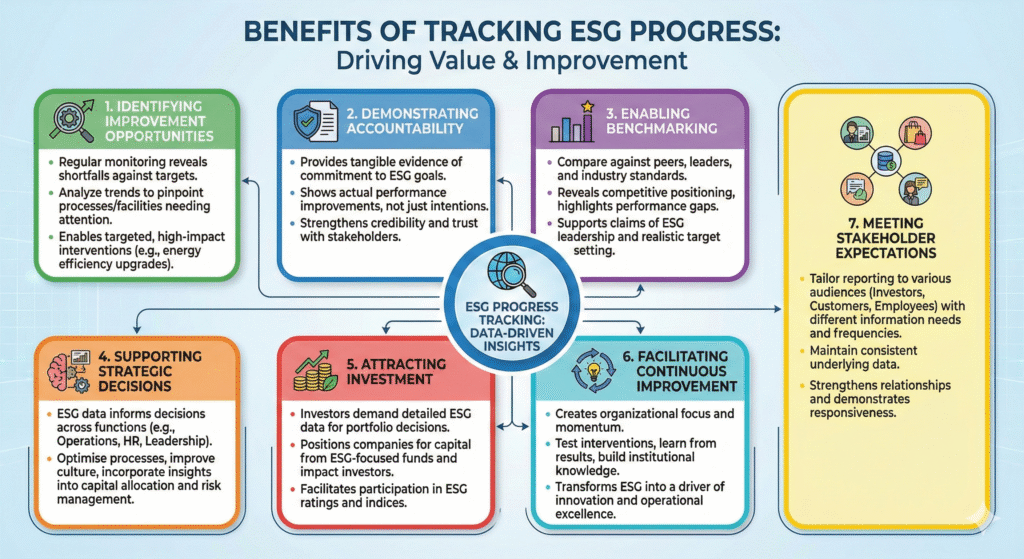

Systematic tracking of ESG performance delivers benefits beyond mere compliance, supporting strategic decision-making and continuous improvement.

- Identifying Improvement Opportunities: Regular monitoring reveals where performance falls short of targets or expectations. By analysing trends and patterns in ESG data, companies can pinpoint specific processes, facilities, or practices that require attention. This insight enables targeted interventions that deliver maximum impact with the resources invested. For example, tracking energy consumption might reveal that particular facilities or equipment consume disproportionate amounts, guiding investment in efficiency upgrades or renewable energy installations.

- Demonstrating Accountability: Progress tracking provides tangible evidence of commitment to ESG goals. Rather than simply stating intentions, companies can show actual performance improvements over time. This evidence-based approach strengthens credibility with stakeholders who increasingly demand proof of action rather than promises. Regular reporting against established KPIs demonstrates that leadership takes ESG seriously and holds itself accountable for results.

- Enabling Benchmarking: Tracking performance using standardised metrics allows comparison against industry peers, sector leaders, and best-in-class organisations. This benchmarking reveals competitive positioning, highlights gaps between current performance and industry standards, identifies areas where the company leads or lags, and provides evidence to support claims of ESG leadership. Understanding relative performance helps companies set realistic yet ambitious targets whilst demonstrating progress to stakeholders.

- Supporting Strategic Decisions: ESG performance data informs better business decisions across functions. Operations teams can use environmental data to optimise processes and reduce waste. Human resources can leverage social metrics to improve workplace culture and retention. Leadership can incorporate ESG insights into capital allocation, risk management, and growth strategies. When ESG tracking is integrated with financial and operational systems, decision-makers gain a comprehensive view of business performance that encompasses both traditional and sustainability metrics.

- Attracting Investment: Investors increasingly demand detailed ESG performance data to inform portfolio decisions. Companies that track and report progress transparently position themselves attractively for capital from ESG-focused funds, impact investors, and mainstream investors integrating sustainability into investment criteria. Robust tracking systems also facilitate participation in ESG ratings and indices that influence investment flows.

- Facilitating Continuous Improvement: The management principle “what gets measured gets managed” applies fully to ESG. Regular tracking creates organisational focus and momentum, enabling companies to celebrate successes and build on what works, identify setbacks early and adjust approaches promptly, test different interventions and learn from results, and build institutional knowledge about effective ESG management. This continuous improvement mindset transforms ESG from a compliance exercise into a driver of innovation and operational excellence.

- Meeting Stakeholder Expectations: Different stakeholders require different information at different frequencies. Investors may want quarterly updates on material ESG metrics. Customers might seek annual sustainability reports. Employees could benefit from regular internal communications about ESG initiatives. Tracking systems that capture comprehensive data enable companies to tailor reporting to various audiences while maintaining consistent underlying information. This flexibility strengthens stakeholder relationships and demonstrates responsiveness to diverse needs.

Effective progress tracking requires establishing clear baselines before initiatives begin, defining specific metrics aligned with goals, setting review frequencies appropriate to each metric, assigning responsibility for data collection and analysis, investing in tools that streamline measurement, and creating reporting rhythms that keep ESG visible to leadership. Companies should also anticipate that tracking approaches will evolve as ESG programmes mature and stakeholder expectations shift.

What is ESG Reporting?

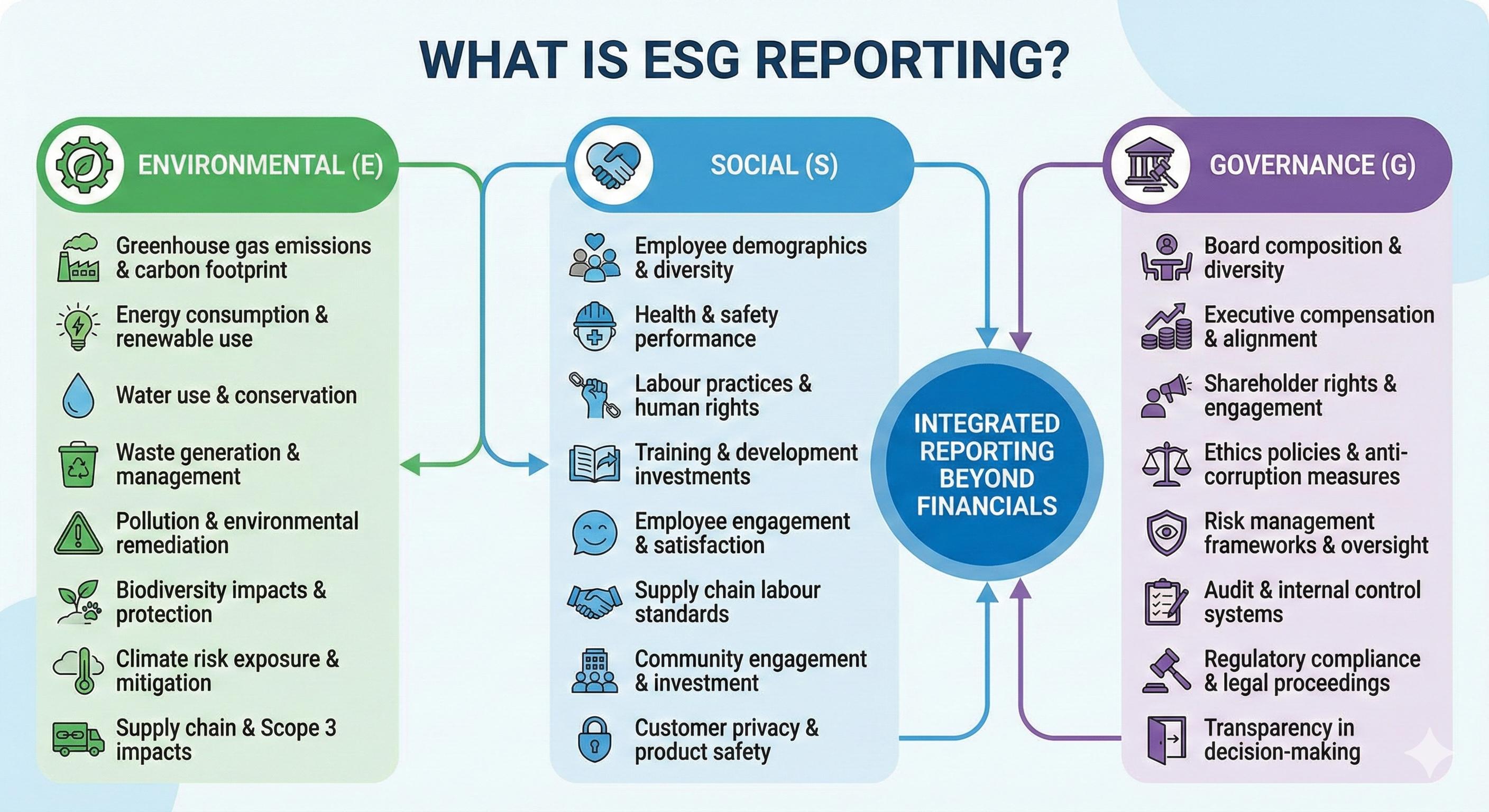

ESG reporting involves systematically disclosing a company’s environmental, social, and governance performance, initiatives, and impacts to stakeholders. This practice provides investors, customers, employees, regulators, and the public with comprehensive information about how organisations address and manage ESG issues.

Unlike traditional financial reporting, which focuses solely on economic performance, ESG reporting encompasses both quantitative metrics and qualitative narratives across three core areas:

- Environmental Reporting discloses data on greenhouse gas emissions and carbon footprint; energy consumption and renewable energy use; water use and conservation efforts; waste generation and management practices; pollution and environmental remediation; biodiversity impacts and protection measures; and climate risk exposure and mitigation strategies. Companies increasingly recognise that ecological reporting extends beyond direct operations to include supply chain impacts, particularly Scope 3 emissions, which often account for the largest share of the total environmental footprint.

- Social Reporting covers metrics related to employee demographics and diversity statistics, health and safety performance, including incident rates, labour practices and human rights protections, training and development investments, employee engagement and satisfaction, supply chain labour standards, community engagement and investment, customer privacy and data security, and product safety and quality. Social disclosure helps stakeholders assess how companies treat their workforce, engage with communities, and manage relationships throughout their value chain.

- Governance Reporting addresses board composition and diversity; executive compensation structures and alignment with performance; shareholder rights and engagement; ethics policies and anti-corruption measures; risk management frameworks and oversight; audit and internal control systems; regulatory compliance and legal proceedings; and transparency in decision-making processes. Strong governance reporting demonstrates that organisations operate with integrity, maintain appropriate checks and balances, and prioritise stakeholder interests alongside shareholder returns.

ESG reports typically take the form of standalone sustainability reports published annually, dedicated sections within annual financial reports, or integrated reports that combine economic and sustainability information in a single document. Leading companies ensure their ESG data reaches various stakeholders through multiple channels, including corporate websites, investor presentations, social media communications, and direct stakeholder engagement.

The quality of ESG reporting varies significantly across organisations. Best-in-class reports provide specific, measurable data rather than vague statements; include both achievements and areas needing improvement; explain methodologies and boundaries clearly; offer year-over-year comparisons showing trends; align with recognised reporting frameworks; undergo third-party verification or assurance; and respond to stakeholder priorities identified through materiality assessments. Companies should view ESG reporting not as a compliance burden but as a strategic communication opportunity to demonstrate values, build trust, and differentiate their brand.

What Are ESG Reporting Standards?

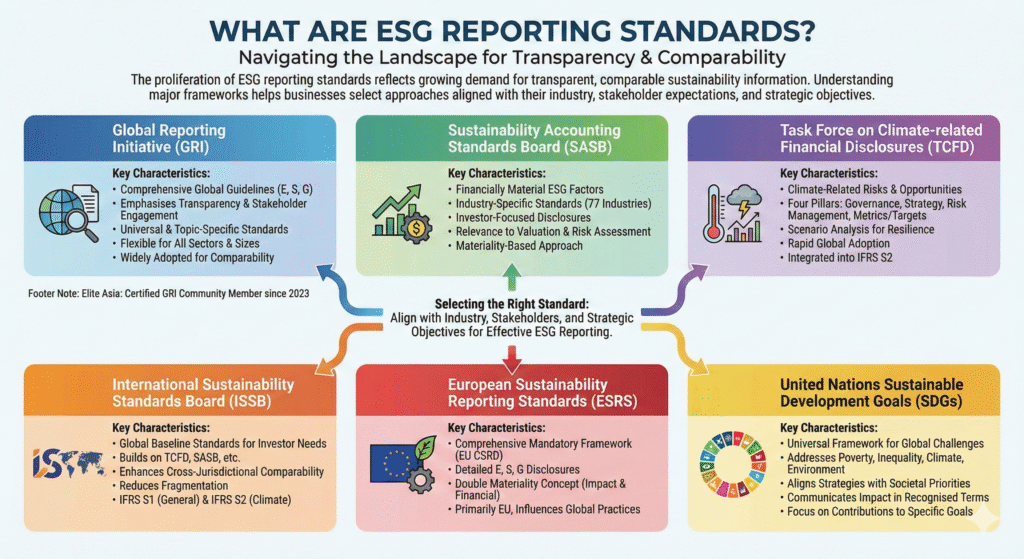

The proliferation of ESG reporting standards reflects growing demand for transparent, comparable sustainability information. Understanding major frameworks helps businesses select approaches aligned with their industry, stakeholder expectations, and strategic objectives.

- Global Reporting Initiative (GRI): The most widely adopted ESG framework globally, GRI standards provide comprehensive guidelines covering environmental, social, and governance topics. GRI emphasises transparency and stakeholder engagement, offering universal standards applicable to all organisations, as well as topic-specific standards addressing issues such as emissions, labour practices, and anti-corruption. The framework’s flexibility makes it suitable for companies across sectors and sizes, whilst its widespread adoption facilitates comparability. Elite Asia became a Certified GRI Community Member in 2023, demonstrating a commitment to advancing sustainability reporting quality.

- Sustainability Accounting Standards Board (SASB): Focused on financially material ESG factors, SASB provides industry-specific standards designed for investor audiences. The framework identifies ESG issues most likely to affect financial performance across 77 industries, helping companies focus their disclosures on topics that matter most to their sector. SASB’s materiality-based approach appeals to investors seeking ESG information relevant to valuation and risk assessment.

- Task Force on Climate-related Financial Disclosures (TCFD): Developed to help companies disclose climate-related risks and opportunities, TCFD provides recommendations across four pillars: governance, strategy, risk management, and metrics/targets. The framework emphasises scenario analysis to assess resilience under different climate futures. Given the centrality of climate change to ESG, TCFD has gained rapid adoption and is increasingly incorporated into regulations. The International Sustainability Standards Board has assumed responsibility for TCFD, integrating its recommendations into the new IFRS S2 standard on climate-related disclosures.

- International Sustainability Standards Board (ISSB): Established under the IFRS Foundation, the ISSB develops global baseline standards for sustainability disclosures that target investor needs. The inaugural IFRS S1 (general sustainability-related disclosures) and IFRS S2 (climate-related disclosures) standards launched in 2023, providing comprehensive frameworks that build on existing initiatives, including TCFD, SASB, and others. ISSB standards aim to enhance comparability across jurisdictions and reduce fragmentation in sustainability reporting.

- European Sustainability Reporting Standards (ESRS): Required under the EU Corporate Sustainability Reporting Directive (CSRD), ESRS represents the most comprehensive mandatory sustainability reporting framework. The standards mandate detailed disclosures across environmental, social, and governance topics, applying the concept of double materiality, considering both how sustainability issues affect the company and how the company impacts society and the environment. Whilst primarily relevant to European companies and those operating in EU markets, ESRS influences global reporting practices given the region’s economic significance.

- United Nations Sustainable Development Goals (SDGs): The 17 SDGs provide a universal framework for addressing global challenges, including poverty, inequality, climate change, and environmental degradation. Whilst not a reporting standard per se, many companies align their ESG strategies with the SDGs and report their contributions towards specific goals. This alignment helps organisations connect their efforts to broader societal priorities and communicate impact in universally recognised terms.

Choosing appropriate standards depends on several factors, including company size and resources, industry sector and material issues, geographic locations and regulatory requirements, stakeholder expectations and information needs, and reporting maturity and capability. Many organisations adopt multiple frameworks, using GRI for comprehensive sustainability reporting, SASB for investor communications, and TCFD for climate disclosures. This multi-framework approach can provide depth across stakeholder needs, though it requires careful coordination to avoid duplication and maintain consistency.

Businesses new to ESG reporting should start by understanding stakeholder priorities through materiality assessments, reviewing frameworks commonly used in their industry, considering regulatory requirements in key markets, and seeking guidance from ESG consultants who can recommend suitable approaches. The goal is to select frameworks that support strategic objectives whilst meeting stakeholder expectations for transparency and comparability.

Setting an ESG Strategy

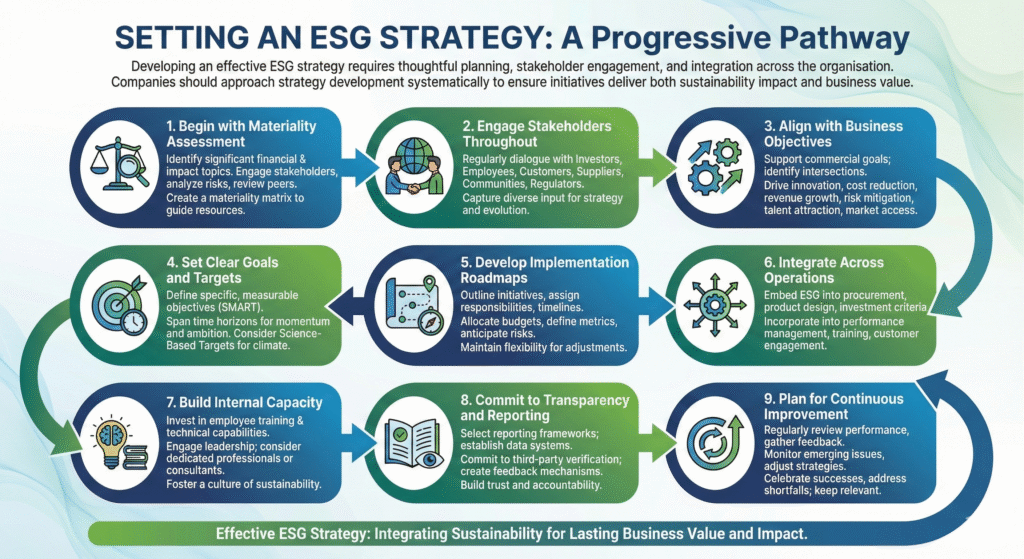

Developing an effective ESG strategy requires thoughtful planning, stakeholder engagement, and integration across the organisation. Companies should approach strategy development systematically to ensure initiatives deliver both sustainability impact and business value.

- Begin with Materiality Assessment: Understanding which ESG issues matter most forms the foundation of strategy. Materiality assessments identify topics that significantly influence business value (financial materiality) and where the company has substantial environmental or social impacts (impact materiality). This process involves engaging stakeholders to understand their priorities and concerns, analysing industry-specific risks and opportunities, reviewing peer practices and emerging issues, and evaluating regulatory trends and expectations. The output, a materiality matrix, guides resource allocation towards matters of most significant importance.

- Engage Stakeholders Throughout: Effective ESG strategies reflect input from diverse voices. Companies should establish regular engagement mechanisms with investors to understand ESG expectations and reporting needs; employees to capture ideas and secure buy-in; customers to align initiatives with market preferences; suppliers to address value-chain impacts; communities to understand local priorities and concerns; and regulators to anticipate policy developments. Stakeholder engagement should occur not just during initial strategy development but continuously as programmes evolve.

- Align with Business Objectives: ESG strategy must support, not compete with, commercial goals. The most successful approaches identify where sustainability and business strategy intersect, such as innovation opportunities in sustainable products and services, cost reduction through resource efficiency, revenue growth from eco-conscious customer segments, risk mitigation related to climate and social issues, talent advantages from a strong ESG reputation, and market access through supply chain sustainability. This alignment ensures ESG secures resources and executive support whilst delivering tangible business benefits.

- Set Clear Goals and Targets: Vague aspirations don’t drive action. ESG strategies need specific, measurable objectives for each material topic. Goals should follow the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) whilst spanning different time horizons to create both momentum and ambition. Companies should also consider setting science-based targets for climate goals, aligning their emission-reduction pathways with the requirements of climate science to limit global warming.

- Develop Implementation Roadmaps: Strategies require detailed plans outlining how goals will be achieved. Roadmaps should identify specific initiatives and projects required, assign responsibilities to teams and individuals, establish milestones and timelines, allocate budgets and resources, define metrics and tracking mechanisms, and anticipate risks and mitigation approaches. Flexibility is essential; roadmaps should accommodate adjustments as circumstances change and learning occurs.

- Integrate Across Operations: ESG cannot remain siloed in a sustainability department. Effective strategies embed ESG considerations throughout the organisation by incorporating sustainability into procurement decisions, product design processes, capital investment criteria, performance management systems, employee training programmes, and customer engagement strategies. This integration ensures ESG principles influence day-to-day decisions across functions.

- Build Internal Capacity: Successful ESG strategies require knowledge and skills throughout the organisation. Companies should invest in training programmes that help employees understand ESG principles and their relevance, develop technical capabilities in areas like carbon accounting or social impact assessment, engage leadership in ESG governance and oversight, and consider hiring dedicated ESG professionals or engaging external consultants. Building capacity ensures the organisation can execute its strategy effectively whilst fostering a culture of sustainability.

- Commit to Transparency and Reporting: Credible ESG strategies include plans to measure, track, and disclose performance. Companies should select appropriate reporting frameworks aligned with stakeholder needs, establish data collection and management systems, define reporting frequencies and channels, commit to third-party verification or assurance, and create feedback mechanisms for stakeholder input. Transparent reporting builds trust whilst creating accountability that drives continuous improvement.

- Plan for Continuous Improvement: ESG strategy development is not a one-time exercise. Leading companies regularly review ESG performance against targets, gather stakeholder feedback on priorities and concerns, monitor emerging issues and evolving best practices, adjust strategies based on learning and changing circumstances, and celebrate successes whilst addressing shortfalls. This continuous improvement mindset keeps ESG programmes relevant and effective over time.

Organisations embarking on ESG strategy development should recognise that the journey unfolds over years, not months. Elite Asia offers comprehensive ESG consultation services to guide companies through strategy development, from initial materiality assessments through implementation planning and reporting.

Why Smaller Companies Should Embrace ESG

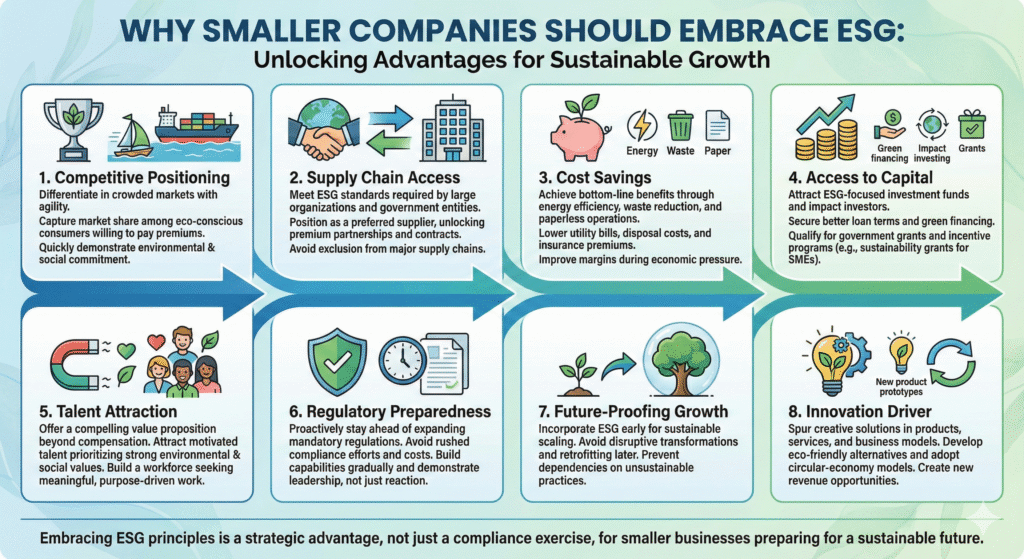

Whilst much ESG attention focuses on large enterprises, small and medium-sized businesses can gain significant advantages by embracing sustainability principles. Several factors make ESG increasingly relevant and beneficial for smaller companies.

- Competitive Positioning: ESG adoption enables smaller businesses to differentiate in crowded markets. Whilst larger competitors may face bureaucratic challenges implementing sustainability initiatives, agile smaller companies can move quickly to demonstrate environmental and social commitment. This agility allows them to capture market share among eco-conscious consumers who increasingly favour businesses aligned with their values. Research shows that consumers are willing to pay premium prices for products from companies with strong sustainability credentials, an advantage smaller businesses can leverage.

- Supply Chain Access: Large organisations increasingly require suppliers to meet ESG standards. Companies without robust sustainability practices risk exclusion from valuable contracts with multinational corporations, government entities, and other major buyers scrutinising supply chain impacts. Conversely, smaller businesses that proactively adopt ESG principles position themselves as preferred suppliers, unlocking access to premium partnerships. This supply chain requirement will only intensify as buyers face pressure to address Scope 3 emissions and broader value chain impacts.

- Cost Savings: ESG initiatives often deliver bottom-line benefits for smaller businesses with limited resources. Energy efficiency improvements reduce utility bills, waste reduction lowers disposal costs, paperless operations cut material expenses, and preventive health and safety measures reduce insurance premiums and lost-time incidents. These operational efficiencies help smaller companies improve margins whilst advancing sustainability, a beautiful combination during periods of economic pressure.

- Access to Capital: Investors and lenders increasingly factor ESG performance into financing decisions. Smaller businesses with strong sustainability credentials can access ESG-focused investment funds, secure better loan terms from banks offering green financing, attract impact investors seeking social and environmental returns, and qualify for government grants and incentive programmes supporting sustainability. In markets like Singapore, sustainability grants for SMEs provide financial support for ESG reporting and capability development.

- Talent Attraction: Smaller companies often struggle to compete with large corporations on compensation. ESG provides an alternative value proposition. Research indicates that significant percentages of workers, particularly younger employees, prioritise working for organisations with strong environmental and social values. Smaller businesses that authentically demonstrate ESG commitment can attract motivated talent who seek meaningful work with purpose-driven organisations, helping offset compensation disadvantages.

- Regulatory Preparedness: Whilst ESG reporting may currently be optional for many smaller companies, regulatory trends point towards expanding requirements. Businesses that embrace ESG proactively position themselves ahead of mandatory regulations, avoiding rushed compliance efforts and associated costs. Starting early allows smaller companies to build capabilities gradually, integrate sustainability into culture and operations, and demonstrate leadership rather than merely reacting to requirements.

- Future-Proofing Growth: Smaller businesses with growth ambitions should incorporate ESG from the outset. Building sustainability into business models early proves far easier than retrofitting later. Companies that establish ESG principles during their growth phase lay the foundation for sustainable scaling, avoiding the need for disruptive transformations as they expand. This approach also prevents small businesses from building dependencies on unsustainable practices that become costly to change.

- Innovation Driver: Resource constraints force smaller businesses to find creative solutions. ESG challenges can spur innovation in products, services, and business models, creating new revenue opportunities. Sustainability-focused innovation might include developing eco-friendly product alternatives, adopting circular-economy business models, offering sustainability services to other businesses, or identifying niche markets underserved by larger competitors.

Smaller companies should recognise that ESG doesn’t require massive investments or dedicated departments. Starting with simple initiatives, measuring and reducing energy use, implementing recycling programmes, conducting employee satisfaction surveys, and establishing clear ethics policies, builds momentum whilst delivering tangible benefits. As capabilities grow, companies can systematically expand their efforts. Elite Asia’s ESG services support smaller businesses throughout this journey, providing tailored guidance appropriate to company size and resources.

Incorporating ESG

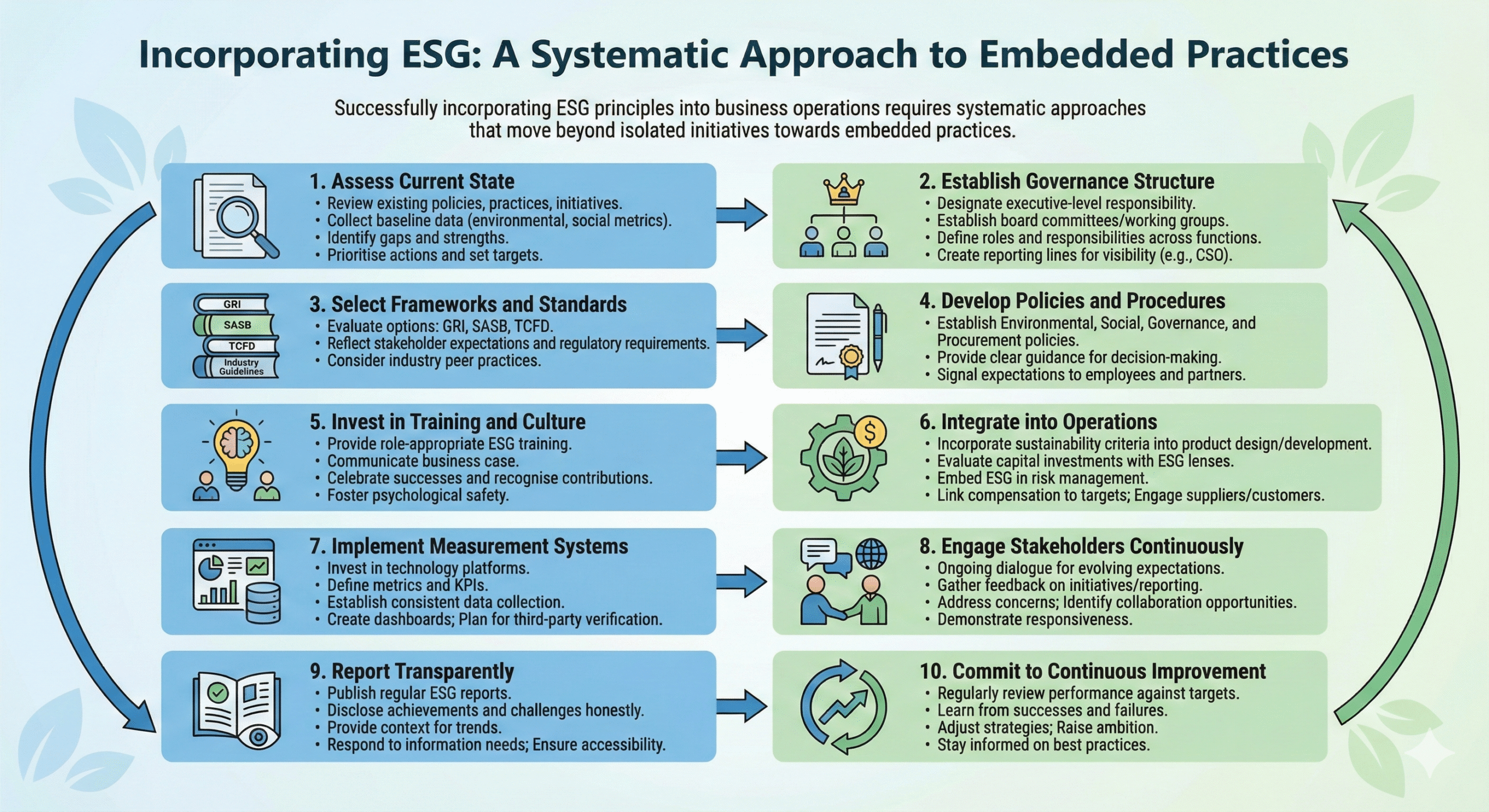

Successfully incorporating ESG principles into business operations requires systematic approaches that move beyond isolated initiatives towards embedded practices. Companies should follow structured processes to ensure ESG integration delivers lasting impact.

- Assess Current State: Understanding the starting point is essential before developing integration plans. Companies should review existing policies, practices, and initiatives related to ESG, collect baseline data on key environmental and social metrics, identify gaps between current performance and stakeholder expectations, and evaluate strengths that can be built upon. This assessment provides the foundation for prioritising actions and setting realistic targets.

- Establish Governance Structure: Clear accountability drives results. Organisations should designate executive-level responsibility for ESG oversight, establish board committees or working groups focused on sustainability, define roles and responsibilities across business functions, and create reporting lines that ensure ESG visibility at senior levels. Many companies appoint Chief Sustainability Officers or equivalent roles to coordinate efforts, though responsibility must extend beyond dedicated positions to encompass the entire organisation.

- Select Frameworks and Standards: Choosing appropriate ESG frameworks provides structure and credibility. Companies should evaluate options, including GRI for comprehensive sustainability reporting, SASB for investor-focused material issues, TCFD for climate-related disclosures, and industry-specific guidelines relevant to their sector. Framework selection should reflect stakeholder expectations, regulatory requirements, and industry peer practices.

- Develop Policies and Procedures: Translating commitments into action requires documented policies and procedures. Organisations should establish environmental policies addressing emissions, waste, water, and biodiversity; social policies covering labour practices, diversity, health and safety, and human rights; governance policies defining ethics, compliance, risk management, and transparency; and procurement policies extending ESG requirements through supply chains. These policies provide clear guidance for decision-making whilst signalling expectations to employees and partners.

- Invest in Training and Culture: Successful ESG integration requires engaged employees who understand sustainability principles and their role in achieving goals. Companies should provide ESG training appropriate to different roles and levels, communicate the business case for sustainability initiatives, celebrate successes and recognise contributions, encourage employee participation in sustainability programmes, and foster psychological safety for raising concerns. Building a culture that values ESG rather than views it as a compliance burden is essential for long-term success.

- Integrate into Operations: ESG principles must influence day-to-day decisions and processes. This integration involves incorporating sustainability criteria into product design and development, evaluating capital investments through ESG lenses, embedding ESG considerations in risk management frameworks, linking executive and employee compensation to sustainability targets, including ESG performance in supplier evaluations, and engaging customers on sustainability benefits and impacts. The goal is to make ESG considerations automatic rather than exceptional.

- Implement Measurement Systems: Tracking progress requires robust data collection and analysis capabilities. Companies should invest in appropriate technology platforms for ESG data management, define metrics and KPIs aligned with goals, establish consistent processes for data collection, create dashboards that make performance visible, and plan for third-party verification of reported data. Measurement systems should evolve alongside ESG programmes, incorporating additional metrics as priorities expand.

- Engage Stakeholders Continuously: ESG integration benefits from ongoing stakeholder dialogue. Regular engagement helps understand evolving expectations and priorities, gather feedback on ESG initiatives and reporting, address concerns and answer questions, identify collaboration opportunities, and demonstrate responsiveness to stakeholder input. Stakeholder engagement should be viewed as a continuous process rather than a periodic exercise.

- Report Transparently: Communicating ESG performance builds trust and accountability. Companies should publish regular ESG reports aligned with their chosen frameworks, disclose both achievements and challenges honestly, provide context to explain performance trends, respond to stakeholder information needs, and make reports easily accessible through multiple channels. Transparent reporting demonstrates commitment whilst creating external accountability that reinforces internal focus.

- Commit to Continuous Improvement: ESG integration is an ongoing journey. Leading organisations regularly review performance against targets and peers, learn from successes and failures, adjust strategies based on feedback and changing circumstances, raise ambition as capabilities grow, and stay informed about emerging best practices and regulatory developments. This continuous improvement mindset ensures ESG programmes remain relevant and practical as both business context and societal expectations evolve.

For businesses seeking support with ESG integration, partnering with experienced consultants can accelerate progress and avoid common pitfalls. Elite Asia provides comprehensive ESG solutions, including consultation, strategy development, reporting, and marketing services tailored to organisations across Asia. With expertise spanning multiple frameworks and industries, Elite Asia helps companies navigate the complexity of ESG whilst building programmes that deliver both sustainability impact and business value.

Take the Next Step in Your ESG Journey

Understanding ESG is just the beginning. Implementing effective environmental, social, and governance practices requires expertise, resources, and commitment. Whether you’re taking your first steps towards sustainability or looking to enhance existing programmes, Elite Asia offers comprehensive support tailored to your organisation’s needs.

Our ESG solutions encompass strategic consultation, materiality assessments, framework selection, sustainability reporting, stakeholder engagement, and ESG marketing, helping businesses across Asia build credible, impactful sustainability programmes that deliver measurable results.

Explore Elite Asia’s ESG Solutions and discover how we can support your organisation’s sustainability journey. From initial assessments through implementation and reporting, our team of experts guides you every step of the way, ensuring your ESG efforts meet international standards whilst creating value for your business and stakeholders.